Simanaitis Says

On cars, old, new and future; science & technology; vintage airplanes, computer flight simulation of them; Sherlockiana; our English language; travel; and other stuff

ON AUTOMOTIVE PRICES (AND, ALAS, LOAN DELINQUENCIES)—PITY GEN Z

A RECENT AUTOMOTIVE NEWS ARTICLE by Paige Hodder describes, “Gen Z Car Buyers Use Research, Digital Tools to Make F&I Deals,” December 1, 2025. (F&I, by the way, is auto dealer shorthand for “Finance and Insurance.”) Hodder recounts, “Gen Z is a growing presence in an auto finance market mired in an affordability crisis and in the middle of major technological shifts. How are these young car buyers and owners navigating it all?”

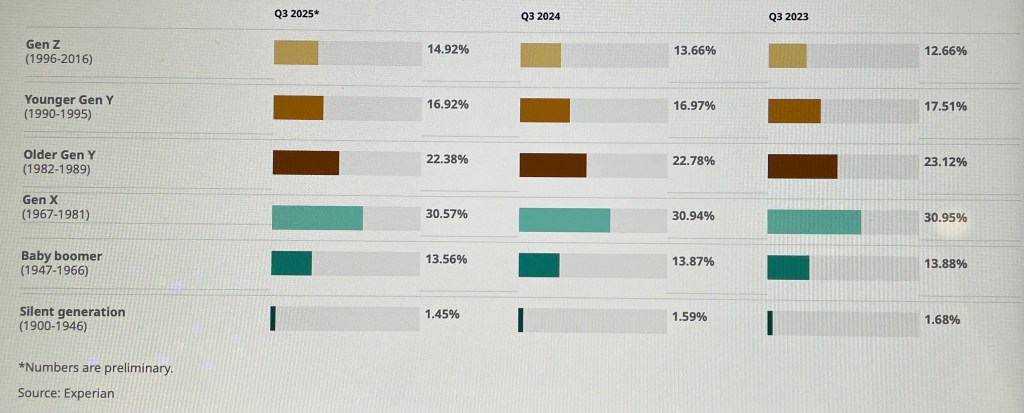

Paige Hodder continues, “In the third quarter of 2025, Gen Z made up almost 15 percent of auto delinquencies over 60 days, according to preliminary data from Experian. That’s up about 1 point from the same period a year earlier. Meanwhile, inflation, student loans and the growing cost of living are straining other parts of their budgets.”

Here are other tidbits gleaned from Hodder’s article, together with my usual Internet sleuthing.

Hodder quotes Dustin Gingerich, finance director at Kokomo Auto World in Indiana on Gen Z buyers: “They know what they want and they know … about what their options are because most of them have been quoted rates. But they’re not expecting the $199, $299 [monthly payments] because they know that those things don’t really exist all that much anymore.”

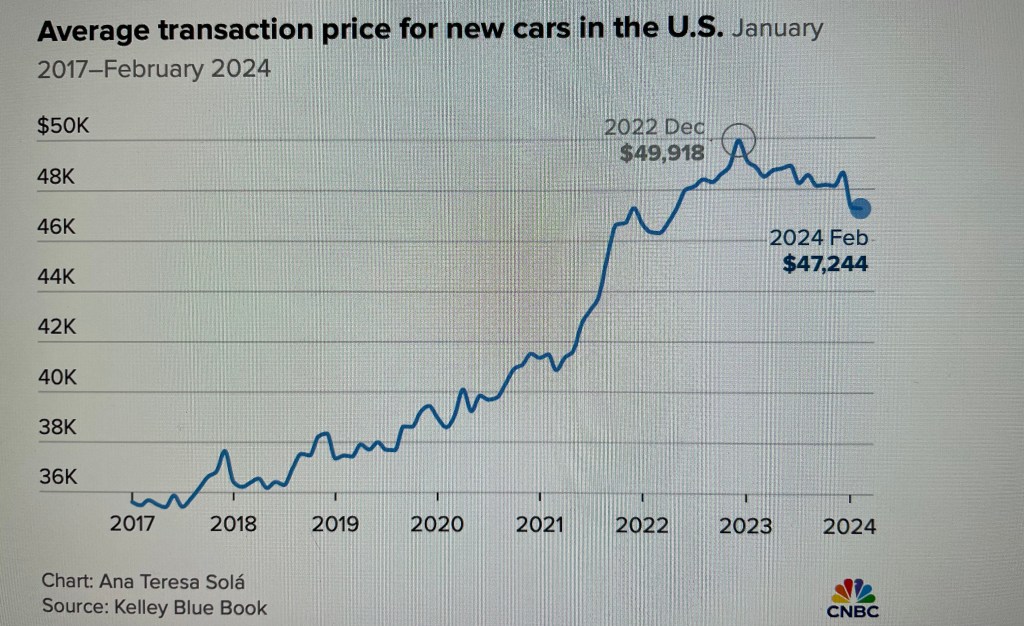

New Car Prices. According to a Google AI Overview, “New car prices are near record highs in late 2025, with average transaction prices (ATPs) often over $50,000, driven by expensive EVs, luxury models, and trucks, despite some downward trends in specific segments like compact cars and increased incentives. You can find detailed charts on sites like Cox Automotive (Kelley Blue Book) and YCharts, showing rising MSRPs and ATPs influenced by inflation, tech, and incentives, with December often seeing higher luxury sales.”

Image from CNBC.

Some Personals: Geez. My most recent new car purchase, a Honda Crosstour in 2012, was around “the average price for a new car that year [which] hovered around $30,000, with specific reports showing figures like $30,282 (September) and $30,832 (November), while the average for a new passenger car was slightly lower at about $26,755, with overall vehicle averages (including trucks) potentially higher.”

As its name suggests, the Crosstour is a “crossover,” sorta halfway between a sedan and conventional SUV.

Size and Features. My Crosstour, admittedly well-equipped for 2012, is missing many features of 2025 automobiles, among them comprehensive driver-assist, today’s highest level of connectivity, and hybrid or fully electric powertrains. Also, many aren’t cars per se: The 2025 vehicle mix is dominated by full-size pickups and what used to be called minivans, as well as top-end luxury SUVs.

Buying These Beasties. Hodder reports, “The average new-vehicle loan in September had a monthly payment of $761 as consumers financed $42,941 over 69.9 months, according to Edmunds. The average used-vehicle loan financed $29,910 over 70.1 months and had an average monthly payment of $570.”

How time (not to say technology) flies. Only 13 years ago, my Crosstour’s new price was comparable with today’s used-car price (downpayment and loan).

Paying for Them. Hodder notes, “Cars.com in August surveyed a nationally representative sample of 1,615 shoppers who planned to buy in the next six months and 613 recent car buyers. The technology provider found about 22 percent of Gen Z respondents said their car-buying decisions are budget-driven.”

I’m not surprised.

Hodder continues, “Meanwhile, 48 percent of Gen Z respondents said they determine their budget based on what they can afford for a monthly payment. The importance of a monthly payment was higher for Gen Z than for millennials or Gen X. ‘Younger shoppers are overall less financially stable and have less flexibility when it comes to a down payment,’ said Jenni Newman, editor-in-chief at cars.com.”

Or, Alas, Not Paying. Automotive News offers a generational breakdown of vehicle owners who are 60-plus day past due on their auto loan payments.

Image from Experian via Automotive News.

Ouch.

Gen Z Challanges. My heart goes out to all younger folks. For example, these Gen Z “digital natives” are beset with challenges in the workplace. CultureMonkey observes, “This new generation of workers is known for its diversity, both in terms of ethnicity and viewpoints. In addition to its diversity in terms of ethnicity and viewpoints, these young employees also differ from other older generations in their digital fluency, entrepreneurial mindset, and a strong emphasis on social justice and inclusion.”

Geez, what with the Trump administration’s anti-D.E.I. madness.

What’s more, they may have uncompleted student loans. Remember the Biden-era SAVE Plan? See also “U.S. Department of Education Announces Agreement with Missouri to End Biden Administration’s Illegal SAVE Plan,” U.S. Department of Education press release, December 9, 2025. And don’t you love its snarky “Illegal”?

Is it too late to begin a crowd-fund for Gen Z? Or at least to educate them about the election process and its consequences. ds

© Dennis Simanaitis, SimanaitisSays.com, 2025